Using Octopus Card in Thailand: Your Ticket to Seamless Transit

In Thailand, the Octopus Card isn't just a piece of plastic – it's your key to smooth and efficient travel. Whether navigating Bangkok's bustling streets or exploring the tranquil countryside, this handy smart card simplifies your transit experience.

Accepted across various modes of transportation and at numerous retail outlets, the Octopus Card ensures seamless payments and hassle-free journeys throughout Thailand. Read on to discover how this tiny card unlocks a world of convenience and ease in your travels.

History and Origin of Octopus Card

The Octopus card is a versatile contactless smart card that emerged as a solution for seamless electronic payments. It was first launched in 1997 across public transport systems in Hong Kong. Initially, the Octopus card was introduced as a simple way to pay fares on public transport, but its applications have since expanded.

The card was established under Creative Star Limited in 1994 and later evolved into Octopus Cards Limited, a subsidiary of Octopus Holdings Limited. In 2001, there were pivotal changes with the transfer of shares, marking the corporation's transition from a non-profit entity to a profitable business and forging strategic alliances with MTR Corporation. After restructuring in 2005, Octopus Holdings Limited was founded, encompassing Octopus Cards Limited as a subsidiary.

Today, the Octopus Card has become an indispensable payment system in Hong Kong, with over 20 million cards in circulation and handling over 10 million transactions a day. It is widely accepted across various transportation modes and retail outlets, making it a convenient and comprehensive payment solution for locals and tourists. The Octopus Card has extended its reach beyond transportation, allowing for small-value payments in the retail sector and various other applications, such as government-tolled tunnels, parking, access control for residential and commercial buildings, and support for school facilities and self-service kiosks.

In addition to its use in Hong Kong, the Octopus Card has expanded to Thailand, offering convenient transactions without physical contact with payment terminals. Its widespread adoption among locals and tourists has transformed it into a must-have for seamless travel and shopping experiences in Thailand. Overall, the Octopus Card has a rich history and has evolved from a simple payment method for public transport to a comprehensive payment system that simplifies transactions and enhances convenience in various sectors.

🚀 Expat Fact

Octopus Card is among Thailand's most extensive and innovative contactless smart card systems.

Where Can I Purchase the Octopus Card in Thailand?

In Thailand, you can purchase an On-Loan Octopus Card at various locations, including MRT stations and BTS stations, and select convenience stores or supermarkets. These cards are available for purchase at dedicated service centers, making it convenient for travelers and locals alike to acquire an Octopus Card and enjoy seamless transactions across transportation and retail outlets in Thailand.

How Does the Octopus Card Works in Thailand?

To use the Octopus Card in Thailand, you need to touch or swipe the card over the Octopus reader. The specific instructions to use the Octopus Cards may actually vary depending on the mode of transportation:

- Trams: Swipe the card when you get off the tram.

- MRT: Swipe the card twice, once at the exit barrier and once at the entrance barrier.

- Buses: Swipe the card when boarding the bus.

- Ferries: Swipe the card at the entrance barrier.

When using the Octopus Card, the reader will emit a beep to acknowledge payment and display the amount deducted and the remaining balance on the card. The transaction time for public transport readers is typically 0.3 seconds, while retailers' card readers take around 1 second. It's important to note that the Octopus Card can also be used for purchases at participating stores and outlets in Thailand, making it a versatile payment option.

Balance Enquiry with Octopus Cards

After every transaction with the Octopus Card in Thailand, the amount deducted and the remaining balance will be displayed on the card reader or a printed receipt. To check the remaining value and transaction history, use the Octopus Enquiry Machines available at MRT stations or Octopus Service Points at high-traffic locations.

Additionally, Octopus cardholders can view their balance and transactions from the previous three months on their mobile phones using the Octopus app. The app also allows checking up to 40 transactions for specific Octopus products. It's important to note that the Octopus Card can be used not only for transportation but also for making purchases at participating stores and outlets in Thailand.

Benefits of Using Octopus Card in Thailand

Using the Octopus Card in Thailand offers several benefits. Firstly, it eliminates the need to carry and count coins or purchase single-journey tickets, making transactions quick and convenient. The Octopus Card can be used for seamless payments across various modes of transportation, including buses, trams, and ferries. It also offers the advantage of discounted fares and promotions, such as discounts on return trips when using Cityflyer Routes to or from the airport.

Additionally, the Octopus Card can be used for payments at a wide range of establishments, including parking lots, retail stores, and recreational centers, providing a convenient and versatile payment solution for transportation and retail transactions in Thailand.

Customized On-loan Benefits of Octopus Cards

Regarding customized on-loan benefits, the Octopus Card in Thailand offers valuable features. Firstly, your personalized Octopus card includes your name and, if applicable, your photo, making it a convenient form of identification.

If you lose your card, you can report it as misplaced and receive a refund for the remaining balance. Once your report is approved, the lost card will be blocked, preventing unauthorized usage by anyone who may find it.

Furthermore, any transactions or auto-reloads made within three hours after reporting the card as lost will not be deducted from your account. This ensures you are not held responsible for unauthorized transactions during that period.

These customized on-loan benefits provide peace of mind and added security to Octopus cardholders in Thailand, making it a very reliable and convenient payment option for transportation and retail transactions.

🚀 Expat Trivia:

There are currently around 20 million Octopus cards in use.

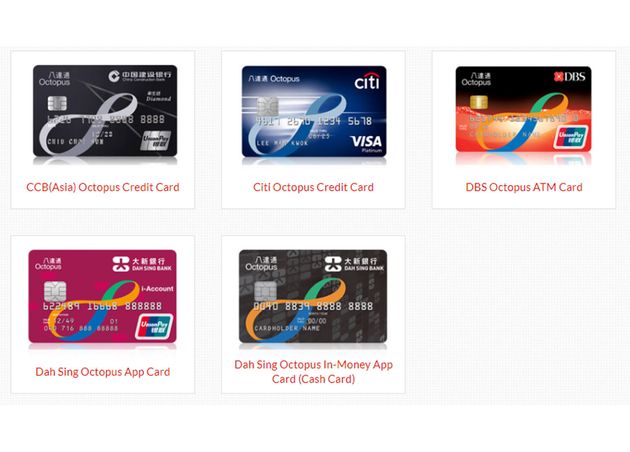

Octopus Cards Co-branded by Banks

When it comes to co-branded Octopus cards, several banks in Thailand offer unique features and policies. These co-branded cards are typically customized and provide additional advantages to customers who already have a relationship with the issuing bank or are interested in the specific benefits offered by these partnerships.

To obtain these co-branded Octopus cards, it is recommended that you contact the respective issuing banks for more information and application procedures. Please note that such specific details and offerings of co-branded Octopus cards may vary depending on the partnering bank. It is strongly advised that you contact the banks directly to inquire about the features, benefits, and eligibility criteria associated with their co-branded Octopus cards.

Understanding On-Loan Octopus Cards

On-loan Octopus cards in Thailand are widely used and provide convenient fare concessions for specific groups. Seniors over the age of 60 and children between the ages of 3 and 11 can enjoy discounted fares when using public transportation with their on-loan Octopus cards. These cards offer a hassle-free and cost-effective way for seniors and children to travel around the country.

Additionally, on-loan Octopus cards are anonymous, ensuring privacy and security. In case of loss, the cards can be reported, blocked, and replaced, minimizing the risk of unauthorized usage. With their fare concessions and user-friendly features, on-loan Octopus cards make commuting more affordable and convenient for children and seniors in Thailand.

How to Pay with Octopus Cards in Thailand

To pay with an Octopus card in Thailand, simply hold the card up to or within a few centimeters of an Octopus card reader. The reader will emit a beep and display the amount deducted and the remaining balance on the card. The transaction time for public transportation readers is typically 0.3 seconds, while retailers' card readers take about 1 second. This quick and convenient payment method allows for seamless transactions on public transportation and at various retail establishments.

Staying Safe When Using Octopus Cards in Thailand

Safety must be prioritized when using Octopus cards in Thailand. The ISO 9798-2 three-pass mutual authentication protocol establishes much more secure communication between the card and the reader, ensuring data encryption and identity verification. Safeguarding the shared secret access key is essential to prevent compromising the Octopus card system's security.

Additionally, Octopus card readers have a fail-safe mechanism that prevents transactions when multiple cards are detected simultaneously, reducing the risk of unintended or unauthorized use. To protect yourself while using Octopus cards in Thailand, it is important to stay vigilant against phishing attempts and unauthorized requests for personal information.

Essential Reminders About Octopus Cards in Thailand

In Thailand, Octopus Cards can be used for cashless payments at various locations, including food courts, convenience stores, vending machines, and other establishments. To pay, hold your Octopus card steadily over the Octopus reader until you hear a "Dood" sound. Wait for the actual transaction to finish and check the remaining amount displayed on the screen before removing your card. If the transaction is interrupted due to quick movement, you must start the transaction again.

It is not recommended to hold multiple Octopus cards or different contactless smart cards over an Octopus scanner simultaneously. Doing so may cause interference and affect the transaction's accuracy. To ensure the proper functioning of your Octopus card, avoid bending, writing on, scratching, tapping, cutting, or attaching stickers, pictures, or other accessories to the card. Transactions will not be completed if any of these actions have been taken on the card.

Additionally, any remaining saved value on the card will not be reimbursed in such cases. When redeeming a Rental Octopus Card in Thailand, you may be required to pay a deposit of THB 50 at the counter. The staff will deduct a service fee, typically around THB 11 per card, and refund the deposit and any remaining amount upon return.

Please note that if the balance on your Octopus card is zero or negative, it can no longer be used until it is reloaded with sufficient funds in Thai Baht (THB).

Frequently Asked Questions When Using Octopus Cards in Thailand

- Can I connect the Octopus app to my Octopus card in Thailand?

- Yes. You can connect your Octopus card to the Octopus app in Thailand. This allows you to conveniently access your Octopus account, manage your card, view transaction history, and even make payments using your mobile device.

- How can I check the initial stored value on my Octopus card in Thailand?

- To check the initial stored value on your Octopus card in Thailand, you can use Octopus card readers available at MRT stations, buses, and other public transportation services. These readers will display the remaining balance on your card.

- How do I use my physical Octopus card to make a financial transaction in Thailand?

- Using your physical Octopus card to make a payment in Thailand is easy. Tap your card on one of the Octopus card readers found at various locations, including fast food restaurants, convenience stores, and public transportation. The amount paid will be deducted from the stored value on your card.

Experience the Ease of Thailand Travel with Your Octopus Card!

Explore seamless travel across Thailand with your handy Octopus Card! More than just your usual payment method, it's your ticket to convenience and savings. This contactless smart card system was recognized globally for its innovation and earned the esteemed Chairman's Award at the 2006 Global IT Excellence Awards.

With the Octopus Card, navigating Thailand's bustling cities and serene landscapes becomes effortless, offering discounted fares and hassle-free top-ups whenever needed. Say goodbye to cash hassles and hello to simplicity and efficiency with your Octopus Card for an unparalleled travel experience in Thailand!

Lifestyle Bear

More From The Bear World

Moving to Bangkok Guide: Everything You Need to Know

Lifestyle Bear

Using Rabbit Card in Bangkok: A Guide for Convenient Travel

Lifestyle Bear